The Flanders-China Chamber of Commerce organized a webinar on August 28, 2020. Our Co-Founder Jiao Li was invited to share her views on the subject of “Entering the Chinese Market through Cross-Border E-commerce”. Here is a write up of her talk by FCCC.

As Covid-19 dealt a heavy blow to traditional trade, cross-border e-commerce has become a major driving force for stabilizing foreign trade. In the first half of the year, cross-border e-commerce increased by 26%. An expansion in the sector also came because Chinese authorities unveiled supportive measures, including optimizing the business climate, quickening customs clearances, and accelerating payment of export rebates. In April the Chinese government decided to set up 46 new comprehensive cross-border e-commerce pilot zones, bringing the total number to 105. Firms in these zones will enjoy support policies, such as exemption of value-added and consumption taxes on retail exports and less levies on corporate income tax. China’s foreign trade in July rose by 6% year-on-year and exports and imports went up by 10% and 1.6% respectively. China is the EU’s biggest source of imports and its second-biggest export market. China and Europe trade on average over one billion euro a day.

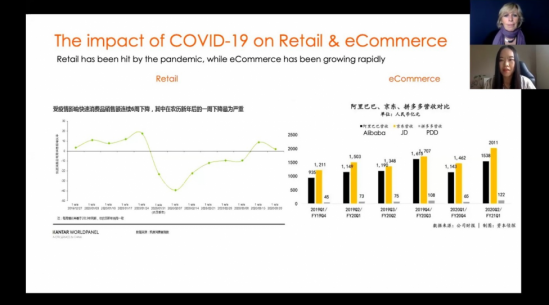

Jiao Li introduced herself by saying that she spent the major part of her career in digital work, especially focussing on e-commerce. China is the biggest e-commerce market and will continue to be so. In 2017 Chinese e-commerce was around USD839 billion, rising to USD1,500 billion in 2019, so it almost doubled in size. The growth rate in 2019 was 16.5%. As a result of Covid-19 there was a drop during Chinese New Year and in March and then the growth rate recovered to about zero. Although China has been hit by the pandemic, e-commerce has still been growing rapidly.

What is driving e-commerce growth? Jiao Li showed two pictures of purchases by her brother and sister on the major e-commerce event Double 11, like Black Friday online. Her sister bought cosmetics from big brands or luxury brands worth about GBP1,000. Her brother bought something tailor-made in the UK worth about GBP600. Jiao Li is from a lower-tier small city in China with only 300,000 people. The average monthly income is around GBP200 to GBP300, but they are spending such a huge amount in e-commerce, buying things they don’t have access to in the off-line retail market. The new growth driver for e-commerce is lower-tier cities, where people are earning much less than in tier-1 cities but spending almost the same amount online at the same spending frequency per week. The new growth driver is small-town youngsters. City elites between 25 and 44 years old in tier-1 cities number 30 million, but small-town youngsters between 18 and 30 years old living in tier-3 to 5 cities number 212 million.

How are they driving e-commerce? Before getting married, they are still living with their parents who pay all living expenses, so they can still spend their own money. They have a much easier life compared to the city elites. They have no housing loan, low living expenses, low working pressure, and more leisure time to consume and travel.

The major e-commerce categories which are growing are health, food, and social, such as cosmetics. The e-commerce landscape in China is highly dynamic and constantly evolving. In the West, you have Amazon and E-bay, but many people are still buying directly from consumer websites. The Chinese market is dominated by e-commerce platforms such a Tmall.

Cross-border e-commerce (CBEC) offers an opportunity to enter China faster with relatively low cost and complexity. There are differences between Chinese domestic trade and China Tmall global. In China’s domestic e-commerce you are sometimes required to register your products, which can take up to two years, but there is no such requirement on Tmall Global, nor is there a requirement for specific testing, such as animal testing for cosmetic products. In China domestic trade you need to set up your own business, which can cost a lot of money. On Tmall global you have a 4% commission, an opening fee, and you only need to pay import tax. This can save you a lot of money. Domestically, you need to set up your own supply chain, but through Tmall you can use a central warehouse in Hong Kong or in a free trade zone and ship directly to the consumer. The channel of cross-border e-commerce is still quite small compared to total e-commerce, but it is one of the fastest growing channels in China. China’s cross-border online shopping population is estimated to grow from 15% in 2018 to 25% in 2022, which still means hundreds of millions of people. So how does it works? In cross-border e-commerce customs clearance and payment of taxes only happens after you sell.

How to win in cross-border e-commerce? There are five points:

1. Choosing the right channel is very important.

Tmall Import is leading the market, together with Koala.com, which is also owned by Tmall. There are also social media platforms such as Little Red Book, which have e-commerce functions. Tmall Global is expanding rapidly in tier-3 and 4 cities. It is hosting brands from 120 countries in more than 8,000 categories.

2. Collaborate with your local partner or TP (Tmall partner), which provides Tmall Global merchants with high quality, transparent and one-stop cross-border e-commerce operation services.

They give you the space and infrastructure, and operate your store on a daily basis. You need to choose your partner well. If it is a big partner and you are a small brand, they might not pay much attention to you. You also need to check their reputation, expertise, region and industry focus. The cost of a TP can also vary very much.

3. Chinese eCommerce environment is an ecosystem

aking Alibaba as an example, it is not just an e-commerce company, but a platform for every Chinese internet user for every activity, so you need to consider your marketing strategy. Live streaming has become very popular during the pandemic.

4. IP protection

Your trademarks do not have to be registered in China, only in your own country, but it is recommended to register in China both in English and Chinese.

5. Raise brand awareness before you go into China to sell.

Brands will struggle when entering China too fast without pre-awareness.

Crayfish.io is facilitating cross-border trade and investment, powered by technology. It offers expertise in the form of a full range of China-related business services, connections and capital. The Crayfish accelerator is a China-ready program for tech start-ups. Crayfish can also help you set up your e-commerce store in China.

Let us help you

Visit our online marketplace to hire independent bilingual providers to get your bespoke projects done, or browse our comprehensive range of fixed price services that deliver the best value for money for your cross-border working. For specific enquiries, you can also contact us.