The development of materials and chemical products in China has been one of the most remarkable industrial and scientific transformations in recent history. Over the past few decades, China has rapidly evolved from being a consumer of materials and chemicals to becoming a major player in their production, research, and innovation. In recent years, the materials and chemical products industry in China is characterised by rapid growth, innovation, and a shift towards new materials under the circumstances of global economic and green development. This article focuses on China’s policies regarding new materials, describes the developments in the sector, and explores potential business opportunities between Chinese and UK enterprises.

Policies and strategies

China places significant importance on the development of the new materials industry and has categorised new materials as a focal point within the national high-tech industry, strategic emerging industries, and key areas outlined in the Made in China 2025 initiative. As the utilisation of new materials continues to rise across sectors such as engineering, new energy, and daily necessities, the market potential for new materials is expected to expand even further.

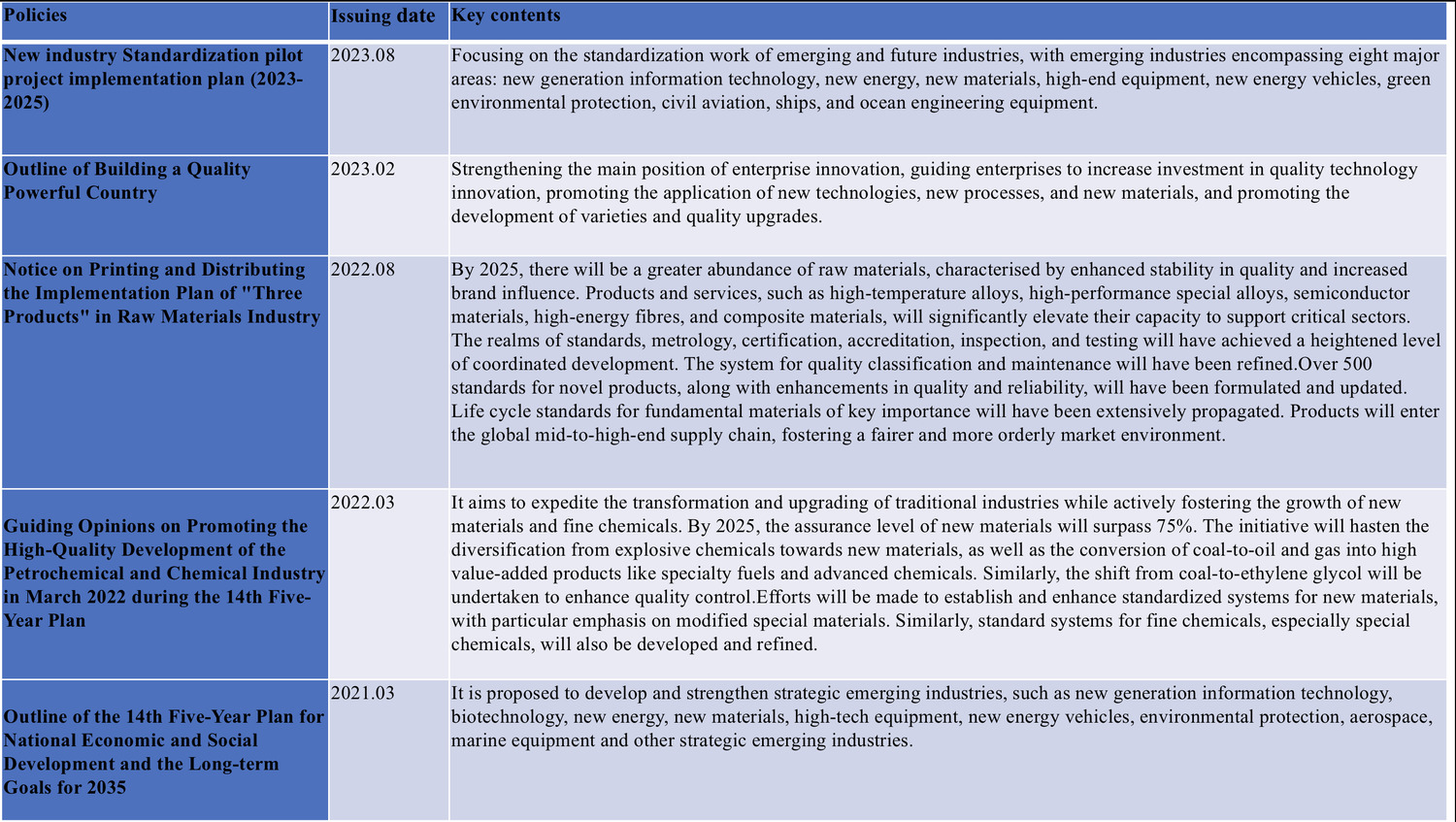

To propel the new materials industry towards greater advancements, China has successively released a series of pertinent industrial policies, introducing fresh avenues for industry development. These policies encompass the “13th Five-Year Plan for the Development of National Strategic Emerging Industries,” which notably aims to expedite the growth of strategic emerging sectors including new materials. Additionally, National New Material Industry Development Leading Group has been established, alongside the New Material Industry Development Guide and substantial funding within the scope of Made in China 2025, all of which sustain the provision of policy backing for the new materials sector. The pertinent policies are outlined in the table below:

Moreover, China’s objective to attain “carbon neutrality” by 2060 has significantly influenced the new materials industry. Positioned closely to the forefront of energy, the new materials industry necessitates substantial heat and electricity for the production of associated goods. Consequently, the supply of these energy sources stands as a paramount contributor to carbon emissions. Confronting the imperative of “carbon neutrality,” the utilisation of conventional fossil resources is progressively shifting from serving as “fuel” to becoming “materials.”

Current Status of New Materials Development in China

According to data from the China Petroleum and Chemical Industry Federation Advanced Chemical Materials Committee (ACMC), in 2022, China’s production capacity for new materials exceeded 45 million tons, with an output exceeding 31 million tons and an output value surpassing 1 trillion yuan for the first time. The average growth rate over the past five years has exceeded 20%. Traditional industries like pesticides, dyes, coatings, and other fine chemicals are leading globally. Simultaneously, the production capacity of new electronic chemicals, high-performance fibre materials, new energy materials, medical chemicals, construction chemicals, and other specialty chemicals is experiencing rapid growth.

In 2022, China’s production of polysilicon, silicon wafers, cells, and battery components reached 827,000 tons, 357 GW, 318 GW, and 289 GW, respectively, setting a record high. The industrial structure is rapidly advancing toward higher levels of sophistication, refinement, and specialisation. The intensity of investment in research and development (R&D) has consistently grown. The proportion of R&D investment relative to the industry enterprises’ sales revenue has averaged 1.29%, with several high-tech industry enterprises surpassing 6%.

The innovation system, centred around enterprises and bolstered by collaboration between industry, education, and research, has seen further enhancement. Significant strides have been made in key technologies and core equipment within the realms of new energy, advanced polyolefins, specialised engineering plastics, high-efficiency separation membranes, and biochemical industries.

The development of the new materials industry is primarily propelled by markets such as automobiles, construction, and electronic appliances. China has proactively nurtured sectors including new energy, high-speed rail, energy conservation, and environmental protection, thereby broadening the scope of applications for new materials. From a downstream industry perspective, new materials find primary usage in related sectors such as energy-efficient technologies, new energy vehicles, next-generation information technology, aerospace, rail transit, environmental conservation, and overall healthcare.

The recent release of “China Petroleum Market Situation and Prospects” by the China Petroleum Group Economic and Technology Research Institute projected that the demand for new materials in the field of new energy will continue to experience rapid growth, with materials like ultra-high molecular weight polyethylene, carbon fibre, photovoltaic EVA, and POE entering a phase of developmental opportunities.

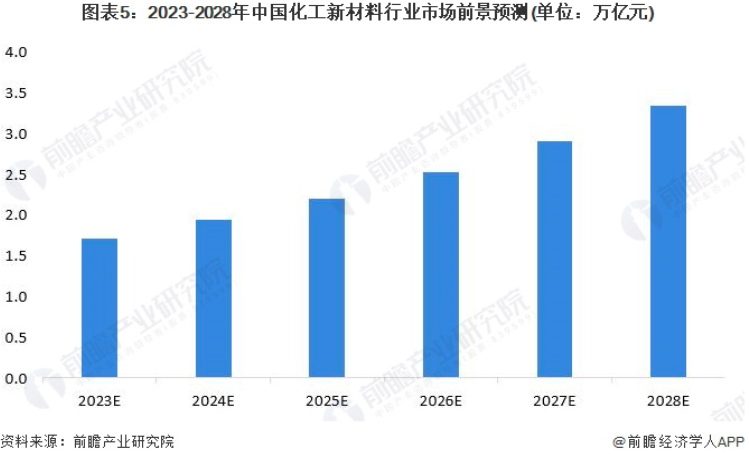

The China Petroleum and Chemical Industry Federation has foreseen that by 2025, the comprehensive domestic market size for new materials will exceed 2 trillion yuan, domestic new materials consumption will surpass 57 million tons, and the self-sufficiency rate will achieve 78.0%. Qianzhan Economics has estimated that the compound growth rate of China’s new materials market will be around 15% from 2026 to 2028. By 2028, the overall market consumption scale is projected to exceed 3 trillion yuan.

As per information from China’s new materials industry, the current landscape of China’s new materials market has given rise to an industrial cluster development model centred around the Bohai Sea, the Yangtze River Delta, and the Pearl River Delta. There exist disparities in the types of industries and the extent of development across these regions. Among them, the combined output value of materials in Zhejiang, Jiangsu, Guangdong, and Shandong exceeds one trillion yuan. Regions in the Yangtze River Delta, with Zhejiang and Jiangsu as representatives, emphasise new energy vehicles, electronic information, medical care, and high-performance products in the R&D and production of new materials within the chemical industry. The Pearl River Delta, exemplified by Guangdong, primarily concentrates on high-performance steel, high-performance composite materials, and rare earth fields. Meanwhile, the Bohai area, represented by Shandong, places its main focus on strategic basic materials, high-performance materials, and the specialised production of cutting-edge materials.

UK-China collaboration

The development of materials and chemical products in the UK has a rich history and remains a significant aspect of the country’s industrial and scientific landscape. Over the years, the UK has made substantial contributions to various domains within materials science and chemical engineering, spanning from fundamental research to industrial applications. The UK boasts a strong tradition of academic excellence in advancing research in advanced materials and chemical sciences. These institutions have produced pioneering research in fields like nanotechnology, polymers, nanomaterials, additive manufacturing (3D printing), precision engineering, and advanced materials processing techniques.

The UK places great emphasis on developing new materials for sustainable technologies. Research into renewable energy materials, energy storage solutions, and lightweight materials for transportation aligns with global efforts to address environmental challenges. The UK is actively engaged in pursuing green chemistry practices with the aim of reducing the environmental impact of chemical processes. Endeavours are underway to develop more sustainable chemical reactions and processes, ultimately leading to the creation of greener chemical products.

Both the UK and China possess unique strengths and expertise across distinct areas of chemical materials. Collaborative efforts between the two nations can yield the discovery of novel materials, improve manufacturing processes, and the advancement of cutting-edge technologies. This collaboration could facilitate access to both markets, resulting in heightened opportunities for commercialisation and economic growth. In recent years, the two countries have collaborated in various facets of the sector, including academic research, industry certification, and joint ventures. Here are some examples:

In 2021, the University of Edinburgh and Jiangsu Dingying New Materials Co Ltd, a specialist Chinese materials company, initiated a collaborative project to develop graphene-based materials for use in waste treatment and purification applications.

In 2022, UK INEOS and China Petroleum & Chemical Corporation engaged in a series of acquisition and joint venture cooperation agreements through several significant transactions.

The Loughborough-China∙Materials Discipline Joint Training Project, a collaborative teaching initiative between Loughborough University in the UK and China’s 211 Project key universities, aimed at nurturing talent in the realm of materials disciplines.

In 2023, the China Chemical and Engineering Society of China (CIESC) and the Royal Society of Chemistry (RSC) jointly undertook the qualification certification of international engineers in the fields of chemistry and chemical engineering. This effort is in conjunction with the “Memorandum of Understanding on Mutual Recognition and Cooperation of Engineers between China Chemical and Engineering Society of China (CIESC) and the Royal Society of Chemistry (RSC)” signed by CIESC and RSC in 2022.

There exists a significant opportunity to thrive in China’s new materials sector. Whether you possess innovative technologies within the realm of new materials or aspire to broaden your presence in this field, China offers a conducive environment for success. The Chinese government extends policy support to bolster such endeavours, while the nation’s commitment to innovation aligns seamlessly with the advancement of the new materials industry.

To achieve successful collaboration in China, localised support is essential. We are well-equipped to offer the necessary services to ensure your success in this endeavour. We eagerly anticipate engaging in further discussions with you to delve into the finer details.

SUCCEED IN CHINA

At Crayfish, we provide tailored solutions to help you succeed in China and are always happy to discuss how we can support. Get in touch and book a free initial consultation with our specialist team.